The world is in the midst of an epic computer chip shortage, one largely driven by Covid outbreaks and skyrocketing demand.

The chip shortage has forced Ford (F), General Motors and other auto companies to slash their production. Car dealerships don’t have enough new vehicles to meet demand, setting off a wave of new and used car sticker shock.

Warren, in a new letter obtained by CNN, argues that the chip shortage, along with its aftermath, is a prime example of how real people can get hurt when a few companies become too dominant in their fields. The Massachusetts Democrat points out that just five firms control 54% of global semiconductor manufacturing, giving the biggest players “immense market power.”

“This market concentration has reduced competition, allowing giant corporations to deliver massive returns for shareholders,” Warren wrote in a letter sent Thursday to Commerce Secretary Gina Raimondo. “But it has harmed consumers by enabling these dominant companies to increase prices and underinvest in key capabilities, which has the effect of also reducing product innovation and product quality.

The Semiconductor Industry Association responded in a statement to CNN by saying the trade group agrees with Warren that America needs to encourage greater domestic chip making, but it pushed back on the senator’s other points.

“Some of the Senator’s other assertions are simply wide of the mark,” said John Neuffer, CEO of the trade group. “The semiconductor industry is one of the world’s most fiercely competitive, innovative, and economically impactful sectors, revolutionizing entire segments of the economy and dramatically improving our way of life.”

‘Consumers are harmed

The pressure from Warren is the latest example of progressives arguing corporate greed is amplifying historic levels of inflation.

Last week, Warren blasted Hertz for binging on share buybacks instead of investing in new supply that could ease skyrocketing car rental rates.

Similarly, White House economists published a blog post last week that said “dominant” meat processors “use their market power to extract bigger and bigger profit margins for themselves,” contributing to the recent spike in meat prices.

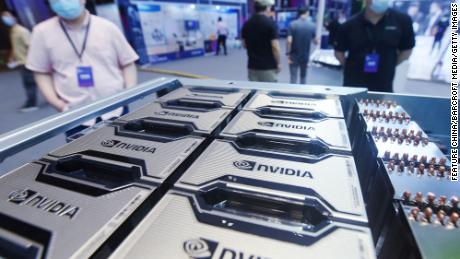

To make her point on computer chips, Warren singled out Taiwan Semiconductor Manufacturing Co., a supplier to Apple, Nvidia and other tech companies, as one of the companies that has grown too powerful. She also said ASML, a Dutch company that trades on the Nasdaq, is the only company making machines required for cutting-edge chips, and it can’t keep up with demand.

“So while dominant semiconductor companies like TSMC and ASML post massive profits and reward shareholders,” Warren wrote, “consumers are harmed by shortages and higher prices.”

Neither company responded to requests for comment from CNN.

The Semiconductor Industry Association noted the industry has innovated rapidly over the years, and that evolution required significant investment.

“Today’s semiconductors are magical, containing tens of billions of transistors on a chip the size of a quarter,” the trade group said in the statement.”Unmatched by any other industry, the semiconductor industry has delivered breathtaking value to consumers. Fifty years ago, transistors were a billion times more expensive than they are today.”

Price spikes

Covid, not corporate concentration, is viewed by many as the near-term driver of the computer chip shortage. Consolidation took place over many years. There was no chip shortage prior to Covid.

The price spikes on cars are the most glaring example of how the computer chip shortage, and supply chain problems in general, have affected everyday people. New car prices spiked by a record 11.1% in November from a year earlier.

But it’s not just about cars. Computer chips are critical components for TVs, exercise machines and appliances — pretty much anything with an on-off switch. And that has contributed to the biggest jump in consumer prices in nearly 40 years.

“These semiconductor manufacturers are putting stock price, profits, and growth ahead of the needs of American consumers and workers,” Warren wrote. “As the COVID-19 pandemic demonstrated, this behavior can lead to terrible consequences and shortages for our country.

Billions in funding could be on the way to chip makers

That’s why Warren is calling on the Commerce Department to use its power in doling out tens of billions of dollars in funding from legislation currently being debated by Congress, and to push back against industry consolidation.

To address the chip shortage and bolster domestic supply chains, Congress last year passed the CHIPS Act, which encourages domestic semiconductor production and research. Just 12% of the world’s computer chips were made in the United States in 2020, down from 37% in 1990.

The Senate has passed legislation that would fund the CHIPS for America Act. Raimondo, the Commerce secretary, has implored the House to do the same.

If that funding gets through Congress, it would open the door to a vast amount of grant funding from the federal government aimed at revitalizing the US semiconductor industry, including $19 billion in fiscal year 2022 alone.

Under the CHIPS Act, the Commerce Department would be in charge of distributing the funds to projects that the Commerce secretary deems are “in the interest of the United States.”

“It is clearly in the national interest of the United States to use this funding to push back against industry consolidation,” Warren wrote to Raimondo. “I encourage you to seize this opportunity through proper utilization and appropriation of these funds, ensuring that American consumers and workers see the full benefits of domestic investment.”

Buyback scrutiny, antitrust action

Warren’s letter included a series of questions to Raimondo over how the Commerce Department plans to choose projects that receive financial assistance, and how the funds will reduce the impact of layoffs and price hikes.

The Massachusetts Democrat also asked how Raimondo will make sure the funds “are not used to pad corporate profits, increase executive compensation and reward shareholders through stock buybacks.”

The Commerce Department was not available to respond to a request for comment.

Concerns about corporate concentration in the chip industry prompted regulators to move to quash what would be the biggest semiconductor acquisition in history. Earlier this month, the Federal Trade Commission launched a lawsuit aimed at blocking Nvidia’s $40 billion takeover of UK chip design firm Arm.

Warren hailed that FTC lawsuit and suggested more action should be just a starting point.

“Although the Trump administration did virtually nothing to stop this harmful consolidation, under President Biden the federal government is beginning to step up to challenge industry consolidation that could harm supply-chain resiliency,” Warren wrote.