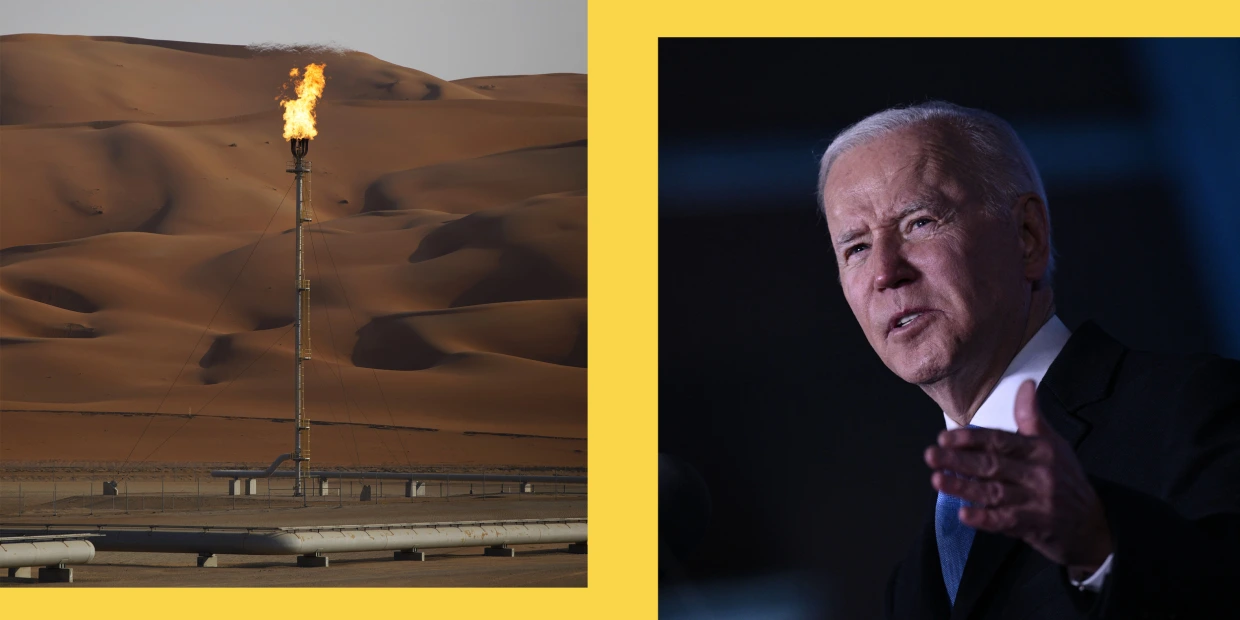

Biden admin officials considering trying to discourage American companies from expanding business ties with Saudi Arabia

Officials said it’s one option on the table as the administration weighs how to respond to OPEC’s cut to oil production without undermining U.S. objectives in the Middle East.

WASHINGTON — Biden administration officials are considering trying to discourage American companies from expanding business ties with Saudi Arabia as part of a U.S. response to a recent Saudi-led push by oil-producing countries to cut global production, said three current and former U.S. officials familiar with the discussions.

The administration also will not send any U.S. official to Saudi Arabia’s annual Future Investment Initiative conference in Riyadh next week, officials said, although a senior administration official said the determination was made before the OPEC+ alliance announced Oct. 5 that it would cut oil production by 2 million barrels a day. The official said the administration was unable to make scheduling work to send a U.S. government official to the high-profile conference, sometimes referred to as “Davos in the desert,” which has been a prized event for Saudi Arabia’s de facto leader, Crown Prince Mohammed bin Salman.

Exploring ways to use American businesses as leverage against Saudi Arabia comes as President Joe Biden says he’s re-evaluating his administration’s relationship with the kingdom and considering how to retaliate against Riyadh over the oil production decision. The current and former U.S. officials said no decisions have been made about whether to proceed with such an effort. They said it’s just one of the options under consideration as Biden considers how to balance responding with not undermining some core U.S. objectives in the Middle East, namely uniting Israel and its Arab neighbors against Iran.

The thinking behind a move to pull back American business investment in Saudi Arabia is that it could influence the kingdom without directly affecting U.S. security in the region, but it also would come with a risk that U.S. businesses won’t listen.

As of now, American companies are set to appear in full force at next week’s Future Investment Initiative conference, which has drawn business executives, investors and government officials. The event has been a platform for the crown prince, also known as MBS, to showcase business opportunities in the kingdom.

Officials acknowledged that it’s too late to affect the turnout of American business executives at this year’s conference, which begins Oct. 25 in Riyadh, even if the administration wanted to do so. The theme of this year’s conference is “Investing in Humanity: Enabling a New Global Order.”

The Biden administration had already downgraded U.S. participation in the conference from the Trump administration’s level of engagement. The Trump administration sent the treasury secretary to the conference, whereas last year the Biden administration sent Deputy Commerce Secretary Don Graves. The Commerce Department confirmed he will not attend this year.

Adrienne Watson, the spokesperson for the White House National Security Council, said the administration has not reached out to American companies to discourage them from doing business in Saudi Arabia.

“We are not reaching out to companies to make such requests,” Watson said in a statement. “As they do in every part of the world, American companies will make their own decisions about their presence and where to invest, taking into account a range of factors, including legal constraints, the business environment and reputational concerns that can arise from public policy choices made by host countries.”

In addition to considering trying to squeeze the Saudis in the business world, a senior administration official said the Biden administration plans to immediately dial back diplomatic and military engagements with Riyadh, describing a cooling of relations that would likely last until OPEC+ leadership holds its next official meeting on Dec. 4, the 34th OPEC and non-OPEC Ministerial Meeting.

The outcome of the December meeting will be pivotal to the future of the relationship between the U.S. and Saudi Arabia, the official said. The meeting convenes the day before a European Union sanctions package against Russia takes effect. The package will include a partial embargo on Russian oil and a ban on importing Russian crude oil from the sea. The sanctions will limit E.U. countries from reselling Russian crude oil and petroleum products.

“That’s going to be a key test, that OPEC meeting,” the senior administration official said. “E.U. sanctions will be going into effect, and a couple million barrels [of Russian oil] will be gone. Does OPEC do nothing then?”

‘Under pressure’

Biden is under pressure from Congress to take dramatic steps, such as cutting off arms sales to the kingdom, and White House officials are furious with Riyadh that after heavy U.S. lobbying not to cut oil production, OPEC+ moved forward with an even larger cut than expected. U.S. officials have said the decision will drive up gas prices and provide an economic lifeline to Russia — a major oil exporter — as it continues its brutal war in Ukraine. Officials also have accused the crown prince of arm-twisting other members of the OPEC+ alliance into the decision.

Saudi Arabia has said the decision does neither of those things, and it has stressed that it was made collectively by a group of countries.

U.S. officials, including the president, have promised a response to Riyadh, but so far none has been implemented, and officials have said decisions would be made in consultation with Congress, which doesn’t return to Washington until after November’s midterm elections.

“The Biden administration seems to be scrambling a bit to find practical measures that could back up the rhetoric from President Biden that there will be consequences,” said Brian Katulis, the vice president of policy at the Middle East Institute.

“One arena where Saudi leaders are very interested in building stronger ties with the United States is in the economic realm and in particular private-sector engagement,” Katulis said. “Saudi leaders are keen to have American businesses and investors come to their country and make big investments to help them advance the goal of diversifying its economy.”

Foreign investment in Saudi Arabia is a core part of the crown prince’s plan to diversify the kingdom’s economy.

Early last year Riyadh announced that starting in 2024 only international companies with regional headquarters in Saudi Arabia could do business with the Saudi government.

The crown prince’s efforts were set back after journalist Jamal Khashoggi was murdered in October 2018. Under bipartisan pressure, Trump administration Treasury Secretary Steven Mnuchin canceled plans to attend the Future Investment Initiative conference held later that month. U.S. intelligence agencies ultimately concluded that MBS approved Khashoggi’s killing. The Saudi government has denied that the crown prince had any role in the murder.

Engagement with Saudi Arabia has picked back up, culminating with Biden’s visit to the kingdom, where he was photographed fist-bumping with MBS in July.

Before the OPEC+ decision this month, U.S. and Saudi officials spent hours discussing the future of oil prices, according to administration officials.

The Saudis told the Americans they were prepared to sustain the increased production until the end of the year, the senior administration official said, and that was the expectation of both the U.S. and other OPEC countries for months.

But then more recently, the Saudis presented the U.S. with an analysis that the price of oil was likely to fall and argued they needed to cut production to avoid a price crater, U.S. officials said. The U.S. disagreed and presented evidence that the prices were likely to remain stable for another 30 days and that the production cut could wait until the next OPEC meeting, and it even argued OPEC could change production at any time if the price started to tank, they said. But, they said, the Saudis wouldn’t budge from their analysis and charts arguing that a price collapse was imminent.